Table of Content

How much you can absorb one go, and how much your subsequent annual earnings will be reduced by, depends on what's known as a scheme's 'commutation issue'. Retirement planning doesn’t must be scary, icky, or overwhelming. At Pension Solutions Canada, we wish to help you plan for the long run with confidence, understanding precisely what you have to do to get the place you wish to go. Think about how you’re going to have the ability to pay in your lifestyle without working. Find an exercise that you simply take pleasure in and may do in retirement to maintain you energetic. You can choose to go to classes, volunteer, or become involved in a company.

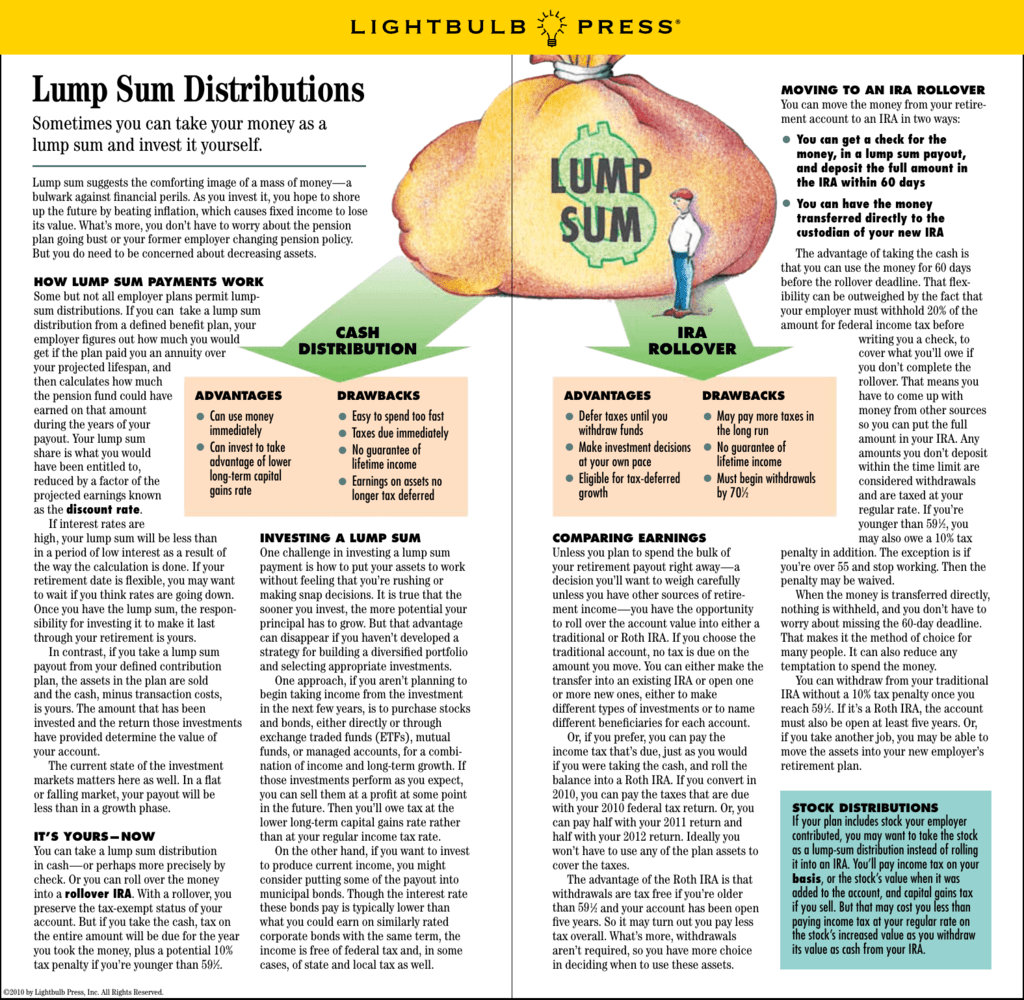

For these transferring the money to an IRA or taking a cash cost, the majority invest the cash in mutual funds. Other savings and funding merchandise include money market funds, financial savings accounts, annuities, shares, and bonds. The 5 firms with the biggest market share have a mixed market share of lower than 25 %. Finally, some pensions provide the right to guarantee that the annuity can pay out over a sure interval regardless of how long you reside. In this example, should you lived longer than 10 years after retiring, the beneficiary wouldn't receive something upon your demise. Most annuity choices closely resemble the choices you'd get from a single-premium quick annuity.

The Annuity Vs Lump Sum: Why The Annuity Is Healthier

Find out if you must make any special pension-related choices whereas still working. Consult with an expert that will help you with this key financial decision! Below are deadlines you should meet should you plan to retire on or before December 1, 2017. The City has a long historical past of funding the Plan and it's in good financial standing.

But the fact is that if somebody retires of their 50s and reside nicely into their 70s and 80s, you possibly can see that 10-year estimates are wanting actuality. There was a time when staff worked till they could no longer physically do their job, and once they retired they died shortly after. What we see at present is employees retiring much sooner in the cycle and residing longer, which translates to considerably greater pension costs which are simply unsustainable. Profit and prosper with the most effective of Kiplinger’s skilled recommendation on investing, taxes, retirement, personal finance and more - straight to your e-mail.

Annuity Vs Lump Sum: What’s The Right Choice?

Finally, you must also contemplate your investing capabilities when weighing up the pros and cons of lump sums vs annuities. If you've a good understanding of investing and the financial markets, then taking a lump sum cost and re-investing it could be a savvy move. Another thing to consider when weighing up the professionals and cons of annuities vs lump sums is the value of the lump sum involved.

It does present that a giant quantity of staff representing billions of dollars have the task of deciding what to do with this cash. When contemplating retirement or a job change from Fortune 500, it's crucial to study your eligibility for a lump-sum fee provided by your retirement plan. For many retirees, having a baseline of income in place can increase consolation and confidence and assist in managing different investments extra flexibly. Consider your scenario and tolerance for market, longevity and different retirement dangers.

Our relationship with CBC permits us to facilitate the purchase of annuities and structured settlements from shoppers who wish to get a lump sum of cash immediately for their stream of monthly funds. When we produce reliable inquiries, we get compensated, in flip, making Annuity.org stronger for our viewers. Readers are in no way obligated to use our partners’ providers to entry Annuity.org assets for free. A pension annuity usually does NOT inflate, but investing proceeds in a lump sum – and rising them successfully – can protect better against inflation over time. However, the onus is on your and/or your advisor to generate a good return and none of us knows what the future holds for markets.

An IRA annuity is somewhat different as a result of it must comply with the IRA payout guidelines somewhat than the annuity guidelines. So in case you have a lump sum payout, set up an IRA not an IRA annuity. Kennedy stated that if many among the 26.2 million people that currently receive monthly pensions are lured by “the dangling of the shiny lump sum,” the so-called “gold standard” of retirement earnings is diminished even additional. She wondered about how that may affect these depending on employer-sponsored 401 plans and Social Security.

The alternative type of annuity, also known as the retirement lump-sum possibility, at one time was one of many normal retirement options and was broadly used. Due to a sequence of price range measures that limited and then nearly ended use of the option, the lump-sum nows out there only to these affected by a medical condition that's expected to take your life inside two years. NerdWallet strives to keep its data accurate and updated.

However, with the lump-sum distribution option you would name a beneficiary to receive any cash that's left after you and your partner are gone. The extra modifications were administrative or technical in nature thatdo notaffect Plan benefits, contributions, eligibility, or retirement cost elections. Pension plans typically make such administrative and technical modifications to clarify administrative procedures and to incorporate them in the Plan Document for all to learn. A Plan Document is the formal, written instrument that establishes a retirement plan and its provisions and describes how the plan is administered.

Watch this video the place we now have particular visitor Jon Hreljac (Retire & Estate Planning Services at Manulife Financial) clarify the advantages of taking your pension’s Commuted Value possibility. Pension funds are made for the relaxation of your life, regardless of how lengthy you live, and may at instances continue after dying along with your spouse. The quantity you withdraw from investments can modified based mostly in your retirement lifestyle needs. On May four, 2017, City Council adopted a change to the calculation of the lump sum cost.

In 1996, employer-sponsored pension plans made up a total of $336 billion in benefit payments – a rise of 6 p.c from 1995 and 31 % from 1991. Of that amount, an estimated 28 p.c ($94 billion) was in lump-sum funds. This amount does not include more than $20 billion that plan individuals choose to depart of their plans. Many individuals aren't snug taking up the duty of investing a large amount of cash, and when you make errors, there is no assure the lump sum shall be sufficient to last you the remainder of your lifetime.

However, doing so entails taking on some danger, and it doesn’t imply your revenue will final for the the rest of your life. It’s essential that you simply hold your utility payments as steady as attainable. Most utility firms permit you to setup a fixed month-to-month payment that doesn’t change from month-to-month, averaging out your utilization over the 12 months. This keeps your payments predictable and simpler to budget for now that you'll be transferring to a fixed income. This changewillaffect any participant who receives retirement benefits on or after January 1, 2018andwho elects to obtain a lump sum payment. The City created the Supplemental Retirement Plan (“Plan”) in 1970 to supply eligible full-time staff with larger monthly retirement payments than provided beneath the Virginia Retirement System (“VRS”).

And a big chunk of your lump sum could probably be taxed at the highest 45% rate, even if your whole earnings for the yr is far decrease. Therefore, it applies a 'Month 1' tax code to your lump sum, which assumes the amount you have withdrawn is 1/12th of your annual revenue. Due to an unfortunate quirk in the tax system, the primary lump sum you're taking out of your pension usually will not be taxed correctly, that means that you'll pay more tax than you need to. In our example, you may sometimes be in a position to take a tax-free lump sum of £85,714 and be left with an annual pension of £12,857. However, not all DB pensions work out how much tax-free cash you'll be able to take in this means. Some schemes, primarily in the public sector, give you separate entitlements to tax-free money.

No comments:

Post a Comment